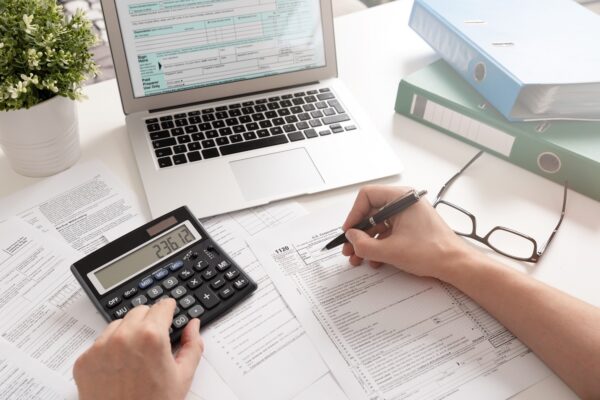

Lease Accounting in 2026: Why Multinational Groups Will Face New Pressures from Currency Volatility and Disclosure Demands

From currency volatility to disclosure demands, multinational groups will face new lease accounting pressures in 2026. Find out what to do about them. Finance teams at multinational groups across the UK have just come through one of the year’s great pressure points: the January reporting cycle. Teams need to deal with the overlap of statutory…